California Nanotechnologies Announces Q3 2024 Results

Jan 16, 2024

- Record quarterly revenue of US$1,159K representing 177% YOY increase

- All-time high quarterly profitability with net income of US$514K and adjusted EBITDA[1] of US$427K

- Stronger balance sheet with US$1,128K of cash on hand and positive working capital1

TSX VENTURE: CNO

OTCMKTS: CANOF

LOS ANGELES, CALIFORNIA, January 16, 2024 - California Nanotechnologies Corp. ("Cal Nano" or the "Company") is pleased to announce record quarterly revenues of US$1,159,234 for the quarter ending November 30, 2023. This represents an increase of 177% compared to the same period last year. Net income for the quarter was US$513,897 compared to a net income of US$64,801 in the same period last year, while adjusted EBITDA1 was US$426,686, compared to US$145,310 in the same period last year. Diluted earnings per share for the quarter increased to $0.02 compared to $0.00 in the same period last year.

Adjusted EBITDA1 showed significant improvements due to higher revenue generation and improving efficiencies at the current scale of operations, which was partly offset by professional fees related to the recently closed non-brokered private placement and shares for debt exchange. Net income also saw improvements for the reasons above and benefited from an unrealized gain on share purchase warrants[2]. The financial statements are available on SEDAR+ at www.sedarplus.ca and on the Company’s website.

"We are thrilled to announce yet another record-breaking quarter, marking the first instance in the Company's history of surpassing US$1 million in quarterly revenues," stated CEO Eric Eyerman. “After closing our first equity issue in almost a decade, we expect to be better positioned to execute on our growing pipeline of opportunities in the 2024 calendar year. The next twelve months will be an important period as we aim to capture new opportunities and make key growth investments.”

The increase in revenue for Q3/FY2024 was attributed to both the ongoing ramp-up of R&D manufacturing programs for new and existing customers and two Spark Plasma Sintering (SPS) equipment deliveries, valued at US$275K. The green steel cleantech customer continues to grow and is the largest account to date with other customers also increasing their scope. Furthermore, Cal Nano does not foresee any further SPS equipment deliveries until FY2025, with an outstanding purchase order from the University of Connecticut worth US$344,000 pending delivery in the mid to late FY2025.

Gross margin1 was slightly weaker due to the lower margins on equipment sales. Profitability increased due to higher revenues, improving operational efficiencies, and an unrealized gain on share purchase warrants2, valued at US$198,973. This profitability was partly offset by professional fees relating to financing costs in the amount of US$79,729. It is anticipated that the adjusted EBITDA and net income margins could fluctuate over time as the Company invests in overhead expenses such as capacity expansion and business development to drive potentially higher future revenues.

As previously disclosed, Cal Nano is in the process of identifying potential new sites for its production facilities and headquarters. While the Company is exploring different options, Cal Nano believes this initiative will be a key step in addressing the immediate and future manufacturing capacity needs of its customers. In addition, there are several pieces of cryomilling and SPS equipment which have been purchased and require additional space to be put into production.

Subsequent to the quarter, the Company has paid US$120,000 toward its borrowings from Omni-Lite Industries Canada Inc. Similar to last year, this constitutes an advance payment encompassing the twelve anticipated US$10,000 principal repayments slated for payment between March 1, 2024, and February 28, 2025. Cal Nano continues to reduce its overall debt and believes that this strategy is necessary to support a growth-oriented technology company.

Lastly, Cal Nano has amended its investor relations service agreement with Otis Investor Relations Inc. to reflect an adjustment in the monthly service fee, from US$2,525 to US$4,000, effective January 16, 2024. This change mirrors the expanded scope of services being offered to the Company going forward.

About California Nanotechnologies Corp.

At Cal Nano, we envision a world in which our advanced technologies are used to help make the most innovative products on this planet and beyond. Global leaders trust us to help push the boundaries of applied material science by utilizing our unique technical expertise and vision. Headquartered in Los Angeles, California, Cal Nano hosts advanced processing and testing capabilities for materials research and production needs. Customers range from Fortune 500 companies to startups with programs spanning aerospace, renewable energy, defense, and semiconductors.

For further information, please contact:

California Nanotechnologies Corp.

Eric Eyerman, CEO

T: +1 (562) 991-5211

info@calnanocorp.com

Otis Investor Relations Inc.

Brandon Chow, Principal & Founder

T: +1 (647) 598-8815

brandon@otisir.com

Non-IFRS Measures and Reconciliation of Non-IFRS Measures

This press release makes reference to certain non-IFRS measures. These non-IFRS measures are not recognized measures under IFRS, do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement those IFRS measures by providing a further understanding of results of operations of Cal Nano from management’s perspective. Accordingly, they should not be considered in isolation nor as a substitute for analysis of the financial information of Cal Nano reported under IFRS. The Company uses non-IFRS measures such as EBITDA to provide investors with a supplemental measure of operating performance and thus highlight trends in its core business that may not otherwise be apparent when relying solely on IFRS financial measures. Management also believes that securities analysts, investors and other interested parties frequently use non-IFRS measures in the evaluation of issuers. Management also uses non-IFRS measures in order to facilitate operating performance comparisons from period to period, prepare annual operating budgets and assess the Company’s ability to meet its capital expenditure and working capital requirements.

“EBITDA” means the earnings before interest, income taxes, depreciation, and amortization, where interest is defined as net finance costs as per the consolidated statement of comprehensive income.

“EBITDA margin” means the earnings before interest, income taxes, depreciation, and amortization, where interest is defined as net finance costs as per the consolidated statement of comprehensive income as a percentage of total revenues.

"Adjusted EBITDA" refers to earnings before interest, income taxes, depreciation, amortization, share-based compensation, and the unrealized gain on share purchase warrants, with interest defined as net finance costs as per the consolidated statement of comprehensive income.

"Adjusted EBITDA margin" refers to earnings before interest, income taxes, depreciation, amortization, share-based compensation, and the unrealized gain or loss on share purchase warrants, with interest defined as net finance costs as per the consolidated statement of comprehensive income as a percentage of total revenues.

Reconciliations and Calculations

The tables set forth below provides a quantitative reconciliation of Gross Margin and EBITDA, which are Non-IFRS financial measures, to the most comparable IFRS measure disclosed in the Company’s financial statements. The reconciliation of Non-IFRS measures to the most directly comparable measure calculated in accordance with IFRS is provided below where appropriate.

Gross Margin Reconciliation

|

Amounts in USD |

Three months ended November 30, 2023 |

Three months ended November 30, 2022 |

Nine months ended November 30, 2023 |

Nine months ended November 30, 2022 |

|

Revenues |

1,159,234 |

418,422 |

2,354,453 |

1,019,570 |

|

Cost of Goods Sold |

380,493 |

126,599 |

752,612 |

317,766 |

|

Gross Profit |

778,741 |

291,823 |

1,601,841 |

701,894 |

|

Gross Margin |

67% |

70% |

68% |

69% |

EBITDA and Adjusted EBITDA Reconciliation

|

Amounts in USD |

Three months ended November 30, 2023 |

Three months ended November 30, 2022 |

Nine months ended November 30, 2023 |

Nine months ended November 30, 2022 |

|

Net Income/(Loss) |

513,897 |

64,801 |

763,038 |

88,575 |

|

Interest Expense |

28,280 |

39,421 |

85,187 |

98,813 |

|

Taxes |

(735) |

- |

865 |

800 |

|

Depreciation & Amortization |

36,486 |

35,289 |

109,089 |

105,565 |

|

EBITDA |

577,928 |

139,511 |

958,179 |

293,753 |

|

EBITDA Margin |

50% |

33% |

41% |

29% |

|

Share-based Compensation |

47,731 |

5,799 |

72,699 |

17,396 |

|

Unrealized Loss/(Gain) on Share Purchase Warrants |

(198,973) |

- |

(198,973) |

- |

|

Adjusted EBITDA |

426,686 |

145,310 |

831,905 |

311,149 |

|

Adjusted EBITDA Margin |

37% |

35% |

35% |

31% |

Derivative Liability Recognition for Warrant Issuance under IFRS

On October 30, 2023, the Company successfully closed an issuance of units comprising common shares and warrants, encompassing an aggregate of 5,000,000 warrants, each with an exercise price of CA$0.25. As a result of the Company reporting its financial results denominated in US dollars, and in adherence to the International Financial Reporting Standards (IFRS), the Company is required to report a derivative liability attributable to the aforementioned warrants. Consequently, the Company will recognize a non-cash charge or income inclusion on a quarterly basis, predicated upon the fluctuation in the market price of the Company’s shares, until such time as the warrants either are exercised or expire.

Reader Advisory

Except for statements of historical fact, this news release contains certain "forward-looking information" within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. In particular, forward-looking information in this press release includes, but is not limited to: future financial results, including anticipated profitability and/or lack thereof; statements about future plans, including statements about the planned expansion of the Company’s manufacturing capacity, and new sites for the Company’s production and headquarters; demand for the Company’s services by current and future customers, including existing and future orders for the Company’s SPS equipment and the anticipated revenue therefrom; and the expected future performance of the Company. Although we believe that the expectations reflected in the forward-looking information are reasonable, there can be no assurance that such expectations will prove to be correct. We cannot guarantee future results, performance or achievements. Consequently, there is no representation that the actual results achieved will be the same, in whole or in part, as those set out in the forward-looking information. Forward-looking information is based on the opinions and estimates of management at the date the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking information. Some of the risks and other factors that could cause the results to differ materially from those expressed in the forward-looking information include, but are not limited to: general economic conditions in Canada, the United States and globally; a significant change in demand for the Company’s services and products; industry conditions, governmental regulation, including environmental regulation; the effects of product development and need for continued technological change; the effect of government regulation and compliance on the Corporation and the industry; research and development risks; reliance on key personnel; operations in foreign jurisdictions; protection of intellectual property rights; contractual risk; third-party risk, risk of technological or scientific obsolescence; dependence of technical infrastructure; unanticipated operating events or performance; failure to obtain industry partner and other third party consents and approvals, if and when required; the availability of capital on acceptable terms; the need to obtain required approvals from regulatory authorities; stock market volatility; competition for, among other things, capital, skilled personnel and supplies; changes in tax laws; and the other risk factors disclosed under our profile on SEDAR+ at www.sedarplus.ca. Readers are cautioned that this list of risk factors should not be construed as exhaustive.

The forward-looking information contained in this news release is expressly qualified by this cautionary statement. We undertake no duty to update any of the forward-looking information to conform such information to actual results or to changes in our expectations except as otherwise required by applicable securities legislation. Readers are cautioned not to place undue reliance on forward-looking information.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

[1] Non-IFRS Measure

[2] See disclosure under “Derivative Liability Recognition for Warrant Issuance under IFRS”

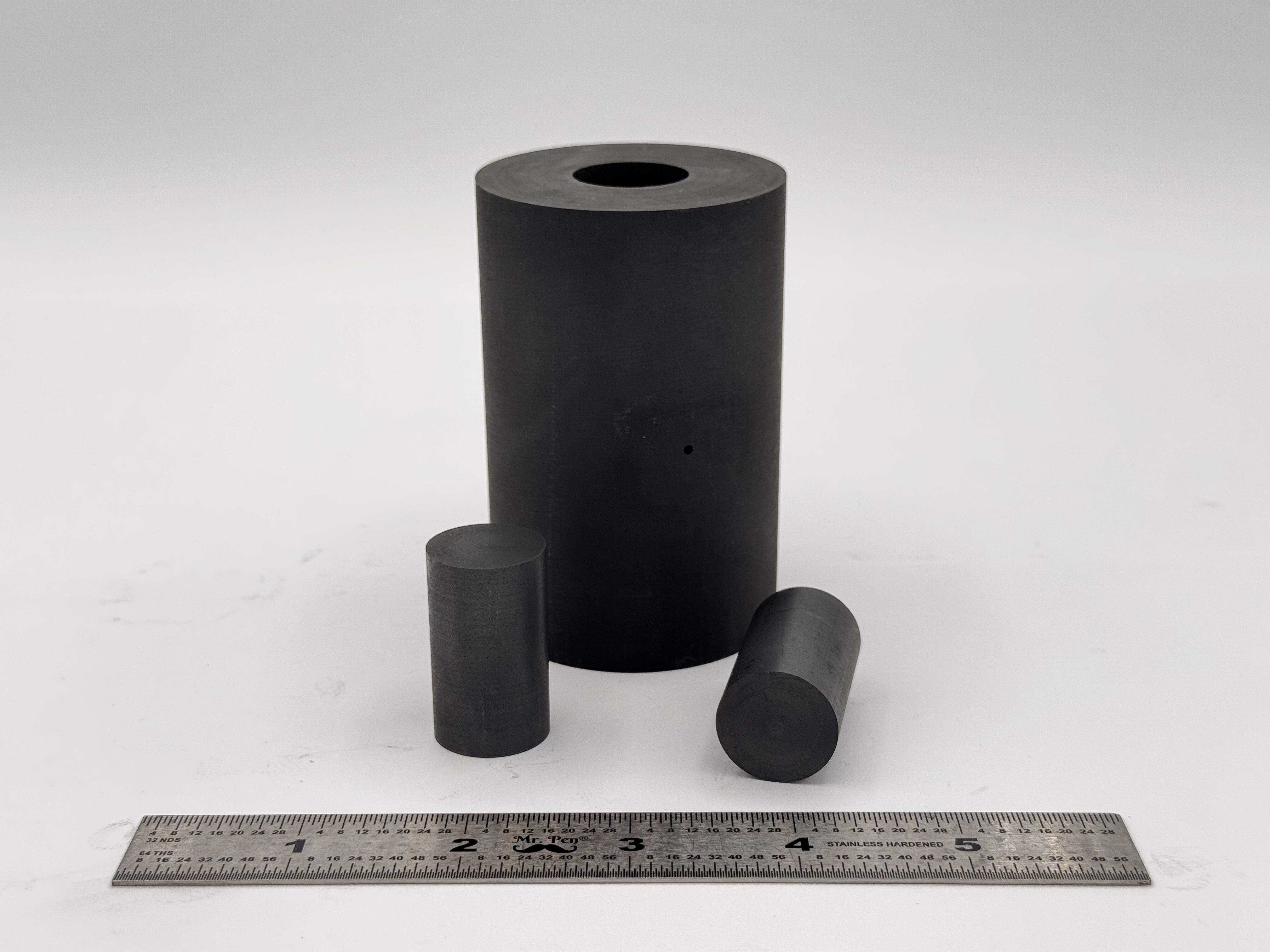

High Strength SPS Graphite Tooling

High Strength SPS Graphite Tooling Tungsten Carbide Tooling

Tungsten Carbide Tooling Carbon Graphite Foil / Paper

Carbon Graphite Foil / Paper Carbon Felt and Yarn

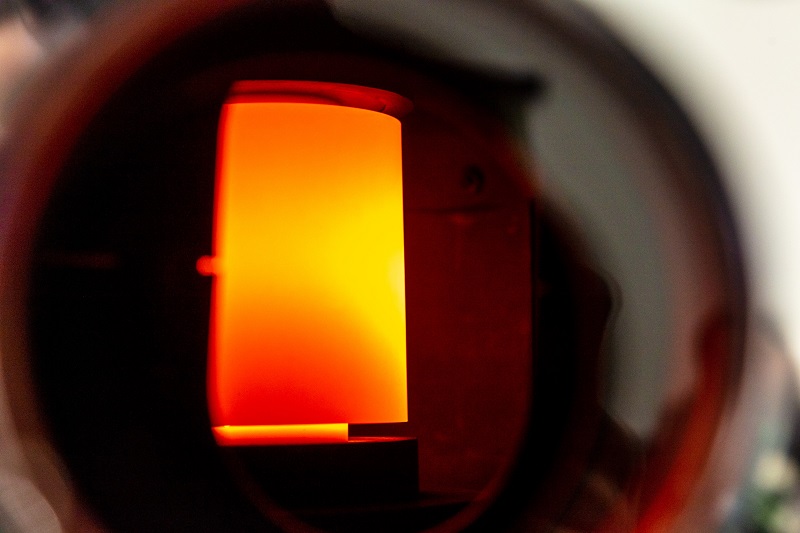

Carbon Felt and Yarn Spark Plasma Sintering Systems

Spark Plasma Sintering Systems SPS/FAST Modeling Software

SPS/FAST Modeling Software