California Nanotechnologies Announces Preliminary Q2 2024 Results and Revised Omni-Lite Debt Agreement

Sep 12, 2023

- Record preliminary quarterly revenue of US$675K representing 148% YOY growth

- Preliminary estimated strong EBITDA1 and net income of US$240K and US$175K respectively

- Partial Omni-Lite loan repayment and conversion of demand loan to fixed term loan

TSX VENTURE: CNO

OTCMKTS: CANOF

LOS ANGELES, CALIFORNIA, September 12, 2023 – California Nanotechnologies Corp. (“Cal Nano” or the “Company”) is pleased to report that unaudited quarterly revenues of approximately US$675,000 are expected for the second quarter ended August 31, 2023. This is expected to represent another quarterly revenue record and a 148% increase over Q2/F2023 revenues of US$271,969. The Company is also expected to continue to deliver strong profitability, with preliminary estimated EBITDA[1] of approximately US$240,000 compared to US$49,437 in Q2/F2023, and preliminary estimated net income of approximately US$175,000 compared to a net loss of US$26,496 for the same period last year.

Q2 2024 (Preliminary & Unaudited) vs. Q2 2023 (Unaudited) Results

|

|

For the quarter ended August 31, 2023 (preliminary & unaudited) |

For the quarter ended August 31, 2022 (unaudited) |

% Change |

|

Revenues |

US$675,000 |

US$271,969 |

148% |

|

EBITDA1 |

US$240,000 |

US$49,437 |

385% |

|

EBITDA margin1 |

36% |

18% |

- |

|

Net income (loss) |

US$175,000 |

(US$26,496) |

- |

The preliminary financial results reported here are based on current preliminary estimates and shall be qualified in their entirety by the Company’s interim financial statements and MD&A for the quarter ended August 31, 2023, which are expected to be filed on SEDAR+ on or before October 30, 2023.

“We are happy to see our hard work come together this quarter as we expect to deliver on our long-term growth objectives. Our team has been busy executing on several opportunities including work with our “green” steel cleantech customer, who is our largest account year-to-date. Across the board, we're observing growth prospects as more customers experience positive outcomes through our advanced material technologies in both Spark Plasma Sintering and Cryomilling,” stated Eric Eyerman, CEO of California Nanotechnologies Corp.

Furthermore, Cal Nano is pleased to announce it has amended certain terms of the loan agreement it has in place with Omni-Lite Industries Canada Inc. ("Omni-Lite"). Omni-Lite, a founding shareholder of Cal Nano, has an equity ownership position in Cal Nano of approximately 19%. At the time of advancement, the loan included a demand feature which resulted in the loan being classified as a current liability on the Company’s balance sheet.

Omni-Lite and Cal Nano have agreed to amend the loan agreement so as to eliminate demand provision in the loan agreement and include certain financial and negative covenants relating to leverage, change of control events, dividends, and other matters. In addition, Cal Nano will provide Omni-Lite with an immediate principal payment of US$100,000 and continue monthly principal payments of US$10,000. This US$100,000 payment is in addition to the US$120,000 accelerated debt prepayment made in Q4/F2023 that covered all required principal payments in F2024.

The interest rate on the loan remains at 7.5% and maturity continues to be set at May 30, 2025. Cal Nano believes that reducing and reclassifying its debt is in the best interests of shareholders and maintains the option to prepay all or a part of the loan at any time. The amendment to the loan agreement with Omni-Lite constitutes a “related party transaction” as defined under the policies of the TSXV and Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The Company is relying on an exemption from the minority shareholder approval requirement applicable to this related-party transaction under section 5.5(a) of MI 61-101, as neither the fair market value nor the consideration to be paid to Omni-Lite exceeds 25% of the Company's market capitalization.

“Cal Nano has significantly reduced its debt in recent years,” stated Eric Eyerman. “Since fully repaying our bank term loan in F2022, we've continued to reduce our Omni-Lite loan. Our debt is now approximately a third less than it was when we initially secured bank loans to purchase our SPS machine in F2017 and F2018. Our aim is to continue this path towards debt reduction from our balance sheet.”

To strengthen Cal Nano’s balance sheet for future capacity expansion, the Company also wishes to announce that it is considering a small equity financing in the near term. Any equity financing is expected to include participation from insiders of the Company.

Lastly, Cal Nano continues to execute on a growing backdrop of industry activity which includes more manufacturing quotes and orders signed for its production services. To create additional awareness, the Company will be attending several industry events in the next quarter which include the MS&T23 Technical Meeting and Exhibition, World Congress on High Entropy Alloys (HEA 2023) and customer specific ones. Cal Nano looks forward to providing updates on its business development and sales traction as developments occur.

Non-IFRS Measures

This news release contains non-IFRS financial measures; the Company believes that these measures provide investors with useful supplemental information about the financial performance of its business, enable comparison of financial results between periods where certain items may vary independent of business performance, and allow for greater transparency with respect to key metrics used by management in operating its business. Although management believes these financial measures are important in evaluating the Company's performance, they are not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with IFRS. These non-IFRS financial measures do not have any standardized meaning and may not be comparable with similar measures used by other companies. For certain non-IFRS financial measures, there are no directly comparable amounts under IFRS. These non-IFRS financial measures should not be viewed as alternatives to measures of financial performance determined in accordance with IFRS. Moreover, presentation of certain of these measures is provided for year-over-year comparison purposes, and investors should be cautioned that the effect of the adjustments thereto provided herein have an actual effect on the Company's operating results.

EBITDA and EBITDA Margin are non-IFRS measures. The EBIDTA figure is defined as net income (loss), excluding interest, taxes, depreciation and amortization. EBITDA Margin is calculated as EBITDA expressed as a percentage of total revenue. A full reconciliation of non-IFRS financial measures used herein to their nearest IFRS equivalents will be provided in the Company's MD&A for the quarter ended October 30, 2023.

About California Nanotechnologies Corp.

At Cal Nano, we envision a world in which our advanced technologies are used to help make the most innovative products on this planet and beyond. We are trusted by global leaders to help push the boundaries of applied material science by utilizing our unique technical expertise and vision. Headquartered in Los Angeles, California, Cal Nano hosts a complement of advanced processing and testing capabilities for materials research and production needs. Customers range from Fortune 500 companies to startups with programs spanning aerospace, renewable energy, defense, and semiconductors.

For more information:

California Nanotechnologies Corp.

Eric Eyerman, CEO

T: +1 (562) 991-5211

info@calnanocorp.com

Otis Investor Relations Inc.

Brandon Chow, Principal & Founder

T: +1 (647) 598-8815

brandon@otisir.com

Reader Advisory

Except for statements of historical fact, this news release contains certain "forward-looking information" within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. In particular, forward-looking information in this press release includes, but is not limited to the expected future performance of the Company, expected financial results for the quarter ending August 31, 2023, the Company’s anticipated timing on repayment of the Omni-Lite debt, the expected effect of amendments to the Omni-Lite debt agreement on the business of the Company, anticipated financings, work on new R&D projects and transitioning into servicing larger, commercial-scale contracts and the Company entering into a growth phase. Although we believe that the expectations reflected in the forward-looking information are reasonable, there can be no assurance that such expectations will prove to be correct. We cannot guarantee future results, performance or achievements. Consequently, there is no representation that the actual results achieved will be the same, in whole or in part, as those set out in the forward-looking information. Forward-looking information is based on the opinions and estimates of management at the date the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking information. Some of the risks and other factors that could cause the results to differ materially from those expressed in the forward-looking information include, but are not limited to: actual financial results for the quarter ending August 31, 2023 will differ materially from the preliminary results reported above; management of the Company will decide not to proceed with a financing in the near future; general economic conditions in Canada, the United States and globally; industry conditions, governmental regulation, including environmental regulation; unanticipated operating events or performance; failure to obtain industry partner and other third party consents and approvals, if and when required; the availability of capital on acceptable terms; the need to obtain required approvals from regulatory authorities; stock market volatility; competition for, among other things, capital, skilled personnel and supplies; changes in tax laws; and the other risk factors disclosed under our profile on SEDAR+ at www.sedarplus.ca. Readers are cautioned that this list of risk factors should not be construed as exhaustive.

The forward-looking information contained in this news release is expressly qualified by this cautionary statement. We undertake no duty to update any of the forward-looking information to conform such information to actual results or to changes in our expectations except as otherwise required by applicable securities legislation. Readers are cautioned not to place undue reliance on forward-looking information.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

[1] Non-IFRS Measure

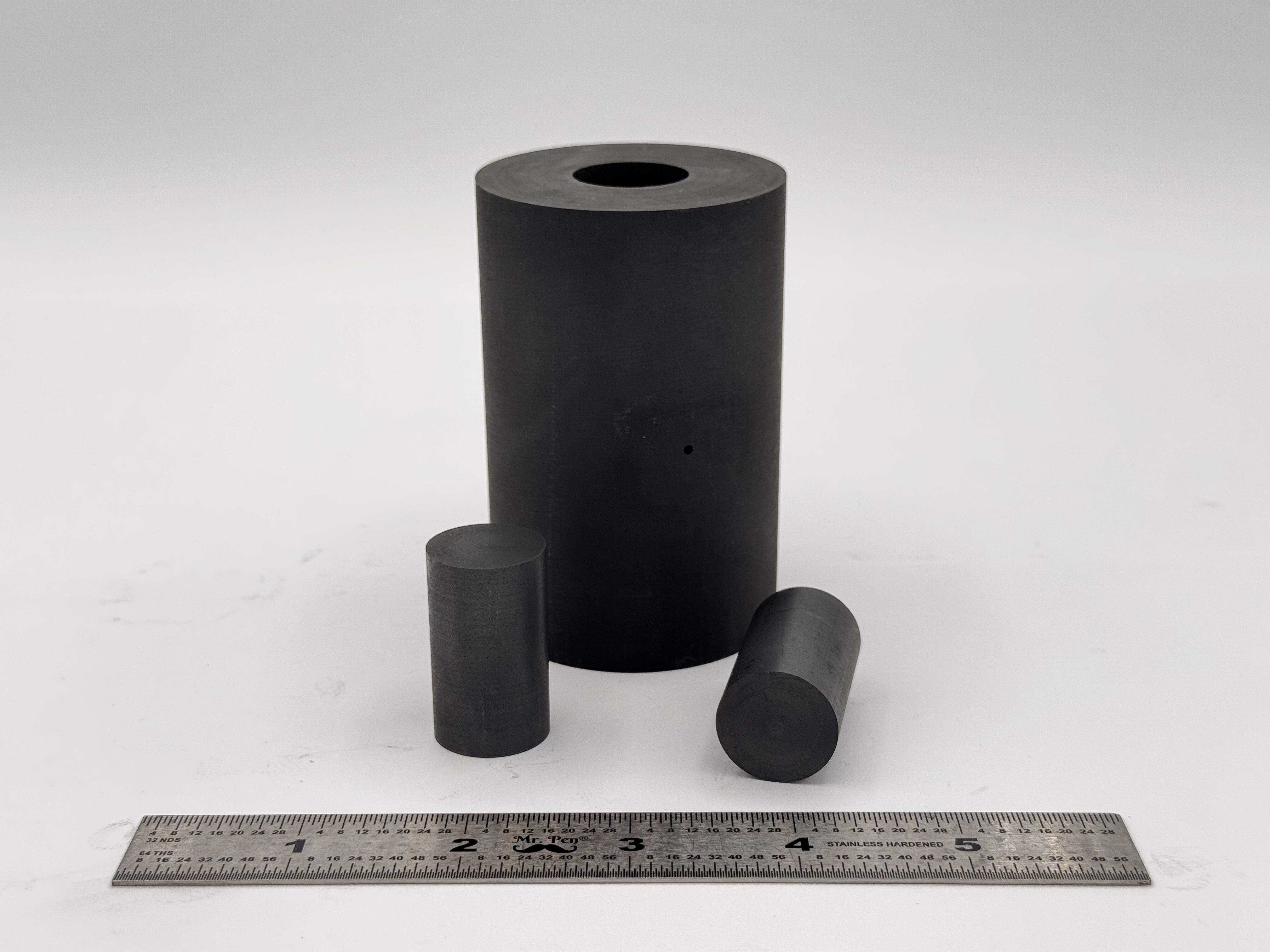

High Strength SPS Graphite Tooling

High Strength SPS Graphite Tooling Tungsten Carbide Tooling

Tungsten Carbide Tooling Carbon Graphite Foil / Paper

Carbon Graphite Foil / Paper Carbon Felt and Yarn

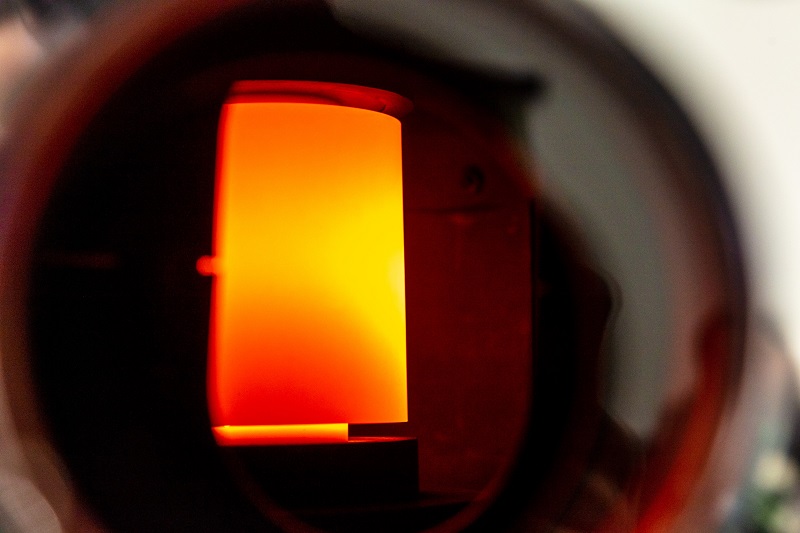

Carbon Felt and Yarn Spark Plasma Sintering Systems

Spark Plasma Sintering Systems SPS/FAST Modeling Software

SPS/FAST Modeling Software