CALIFORNIA NANOTECHNOLOGIES ANNOUNCES RECORD REVENUE FOR FISCAL 2022

Jun 30, 2022

- Company announces record $1.08 MM revenue for Fiscal 2022

- Cal Nano qualifies for ERC & R&D Tax credits valued at approximately $130,000

TSX VENTURE: CNO

OTCMKTS: CANOF

LOS ANGELES, CALIFORNIA, June 30, 2022 - California Nanotechnologies Corp. ("Cal Nano" or the "Company") is pleased to announce record revenues of US$1,081,500 for the year ending February 28, 2022 (“F2022”). This is an increase of 39% from the previous year. Net income for F2022 was US$275,600 and EBITDA was US$479,992, both the highest in Company history by a wide margin. EPS were $0.01 in F2022 versus nil in F2021. Full financial statements are available at sedar.com.

Revenue was US$472,420 in Q4/F2022 versus US$148,164 in the preceding year. EBITDA was US$399,154 in Q4/F2022 up from US$11,658 in Q4/F2021 and net income was US$327,462 in Q4/F2022 versus a net loss US$37,546 in the preceding year. All three results were records for the Company. The results also highlight the earnings leverage inherent in the Company’s sophisticated nanotechnology production processes.

Revenue for F2022 was associated with customers continuing to utilize the Company’s Spark Plasma Sintering and Cryogenic Milling toll services for small- and large-scale R&D programs. However, the largest contribution was from the R&D and first production work for the thermoelectrics customer described in recent press releases. “With a strong Q4, we were able to move the company into profitability for the first time in our history” stated CEO Eric Eyerman.

Cal Nano is in continuing discussion with its thermoelectrics customer on follow up orders after completion of the first round of production earlier this year. The customer has indicated that it satisfied to date with the products we have made for them and we are hopeful of ongoing additional revenue late in 2022 and beyond. Revenue to Cal Nano will depend on, among other things, the timing and success of the commercial roll-out by the customer for its product. The customer has provided Cal Nano with a preliminary demand forecast for calendar year 2023 and 2024 which, if it materializes, would result in a significant revenue increase for Cal Nano. We are currently evaluating what equipment purchases would be necessary to fulfill such potential future revenue. Cal Nano is also beginning to consider how it would fund a capacity expansion.

The Company is pleased to announced its first official sale as the North American distributor for the Japanese SPS equipment manufacturer, SUGA, valued at approximately US$130,000. Cal Nano has been their technical representative for 4 years but this is the first equipment sale as a distributor. Equipment can range from US$100,000 to multi-million dollars. We expect additional SPS equipment sales in the coming year providing an additional income stream and boosting revenue.

The Company would also like to announce that it has been granted full forgiveness for the 2nd round of PPP funding that was established as part of the Consolidated Appropriations Act in order to enable small businesses to pay employees during the economic slowdown caused by COVID-19 by providing forgivable loans to qualifying businesses. The forgiveness was reflected in Other Income in our Q4/F2022 results.

The Company applied for Employee Retention Credits totaling US$66,989 in F2022. The Employee Retention Credit (“ERC”) was also established under the Coronavirus Aid, Relief and Economic Security Act (“CARES Act”) as further economic relief in the form of employer tax credits. Of this amount, US$35,690 was included in receivables at year end.

The Company engaged a third party to perform a Research and Development study to determine if any business activities met the qualifications and be eligible for tax credits pursuant to IRS (26 U.S. Code 41). The results of the study confirmed that some activities did qualify in 2019 and 2020, and tax credits of US$33,352 and US$29,829, respectively, have been claimed. The Company expects to receive the related funds in the 2022 calendar year and will reflect them in other income on receipt.

The Company ended the year with approximately US$50,000 of cash and significant receivables. As a result of normal course receivables collections, the Company now has cash of approximately US$300,000, putting Cal Nano in its strongest financial position in a number of years.

For further information, please contact:

Eric Eyerman, CEO

T: (562)-991-5211

E: info@calnanocorp.com

W: www.calnanocorp.com

Reader Advisory

Except for statements of historical fact, this news release contains certain "forward-looking information" within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. In particular, forward-looking information in this press release includes, but is not limited to the expected future performance of the Company. Although we believe that the expectations reflected in the forward-looking information are reasonable, there can be no assurance that such expectations will prove to be correct. We cannot guarantee future results, performance or achievements. Consequently, there is no representation that the actual results achieved will be the same, in whole or in part, as those set out in the forward-looking information. Forward-looking information is based on the opinions and estimates of management at the date the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking information. Some of the risks and other factors that could cause the results to differ materially from those expressed in the forward-looking information include, but are not limited to: general economic conditions in Canada, the United States and globally; industry conditions, governmental regulation, including environmental regulation; unanticipated operating events or performance; failure to obtain industry partner and other third party consents and approvals, if and when required; the availability of capital on acceptable terms; the need to obtain required approvals from regulatory authorities; stock market volatility; competition for, among other things, capital, skilled personnel and supplies; changes in tax laws; and the other risk factors disclosed under our profile on SEDAR at www.sedar.com. Readers are cautioned that this list of risk factors should not be construed as exhaustive.

The forward-looking information contained in this news release is expressly qualified by this cautionary statement. We undertake no duty to update any of the forward-looking information to conform such information to actual results or to changes in our expectations except as otherwise required by applicable securities legislation. Readers are cautioned not to place undue reliance on forward-looking information.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

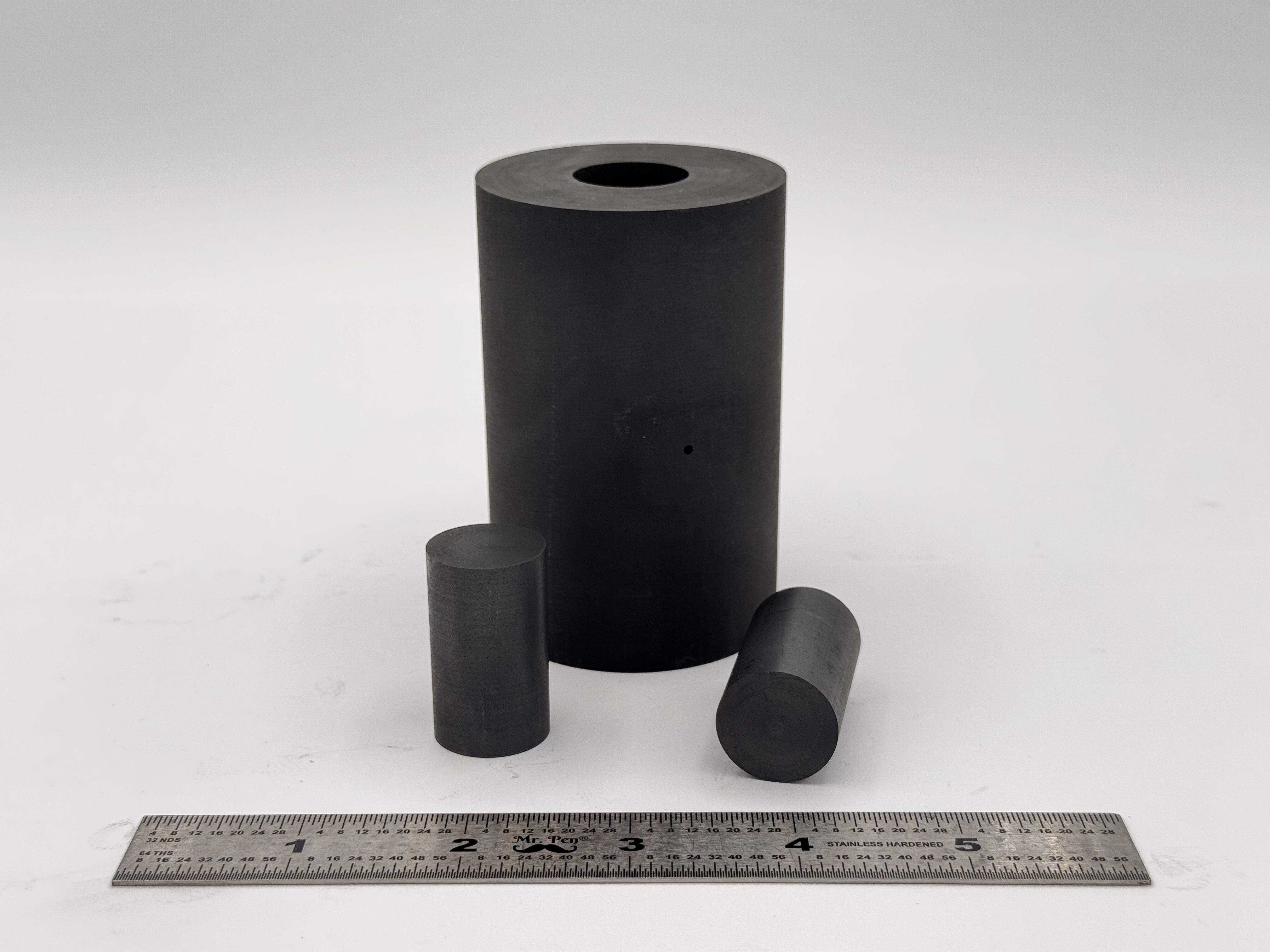

High Strength SPS Graphite Tooling

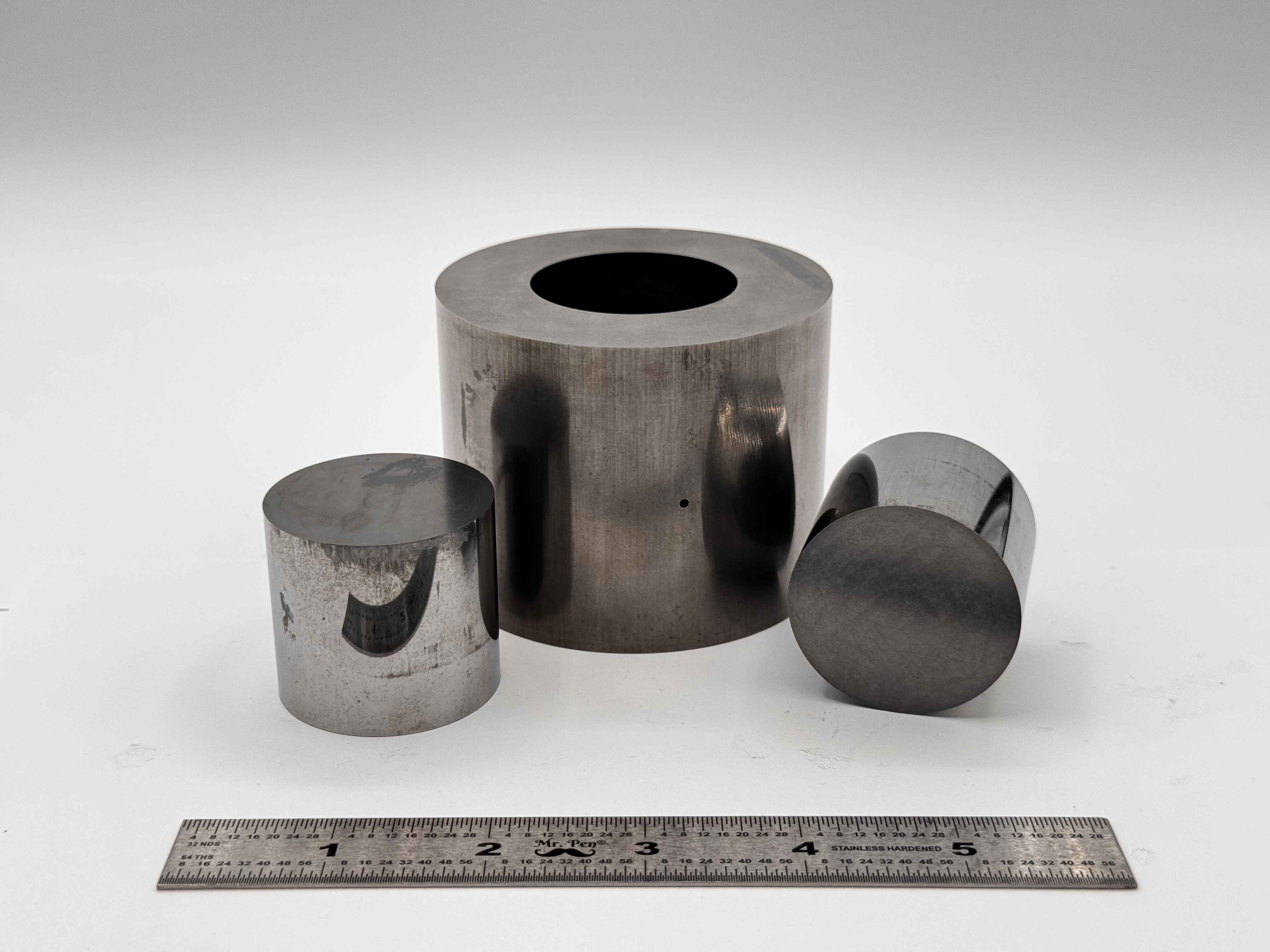

High Strength SPS Graphite Tooling Tungsten Carbide Tooling

Tungsten Carbide Tooling Carbon Graphite Foil / Paper

Carbon Graphite Foil / Paper Carbon Felt and Yarn

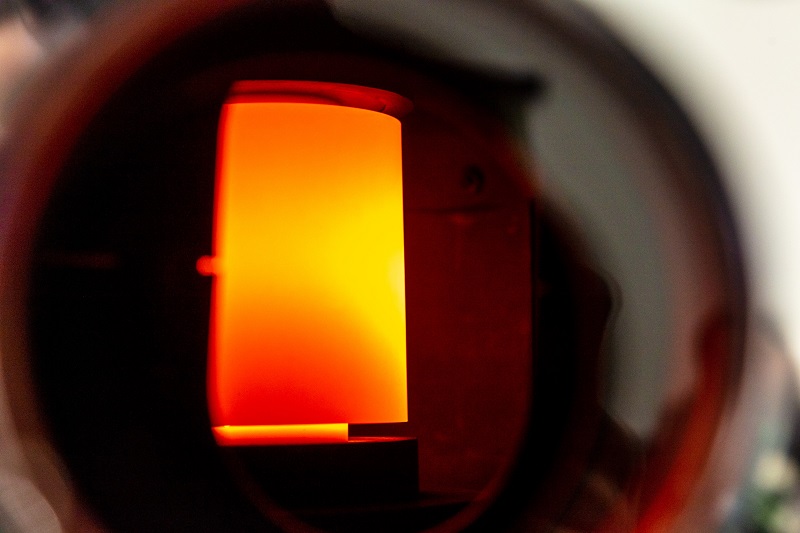

Carbon Felt and Yarn Spark Plasma Sintering Systems

Spark Plasma Sintering Systems SPS/FAST Modeling Software

SPS/FAST Modeling Software